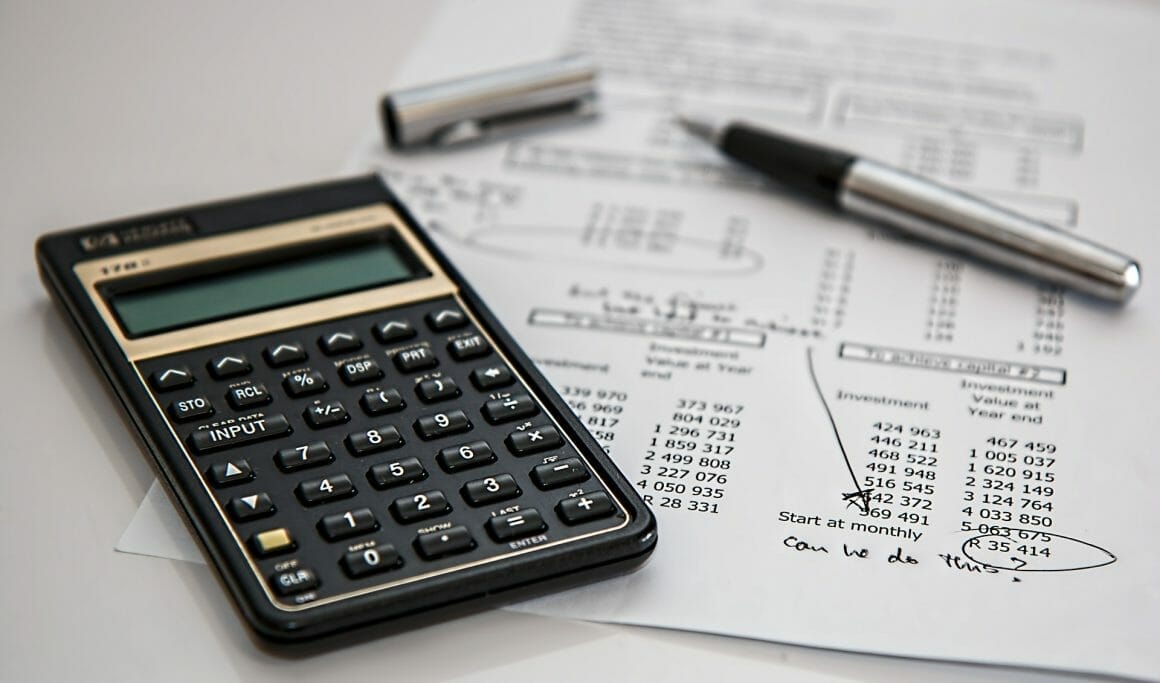

From July 1, the Pennsylvania Department of Revenue will be back to pre-COVID rules. The new rule regards employment tax withholding. Businesses with employees in Pennsylvania and Philadelphia will need to incorporate remote workers’ taxes based on their location.

As the vaccination campaigns move forward, Philadelphia’s Wage Tax rules will apply to remote workers. In spring 2020, the Pennsylvania Department of Revenue (DOR) announced that employees working from home were disregarded for Pennsylvania tax purposes.

New Rules For Remote Workers’ Taxes

The DOR didn’t change the sourcing of the employee’s compensation because of the pandemic. Therefore, non-residents working in Pennsylvania pre-COVID had the same income for all tax purposes. Likewise, Pennsylvania residents working out-of-state would pay their compensation to the other state.

From July 1, this rule won’t apply anymore. Remote workers will pay their compensation based on their location. In the same vein, non-resident workers will pay taxes as a non-Pennsylvania source income.

The Philadelphia Department of Revenue applied similar rules. If employees choose to stay home, who is based in Philadelphia will be taxed on all wages. For more info, the department gives explanations in their FAQs.

As remote work models will stay even post-pandemic, states are moving their tax systems to regulate remote workers’ taxes.