Consumer Services is a thriving and diverse sector, with jobs ranging from hospitality to retail and online services. The key element that makes it a consumer services role is that you work primarily with the end customer or consumer. Finance consumer service jobs are a sub-set of roles that are needed within banks, loan companies, trading platforms, and fintech companies. It’s still a diverse range of roles. But they all have money in common. The great thing about these roles is that many of them can be done remotely, letting you follow your passion for numbers without leaving home!

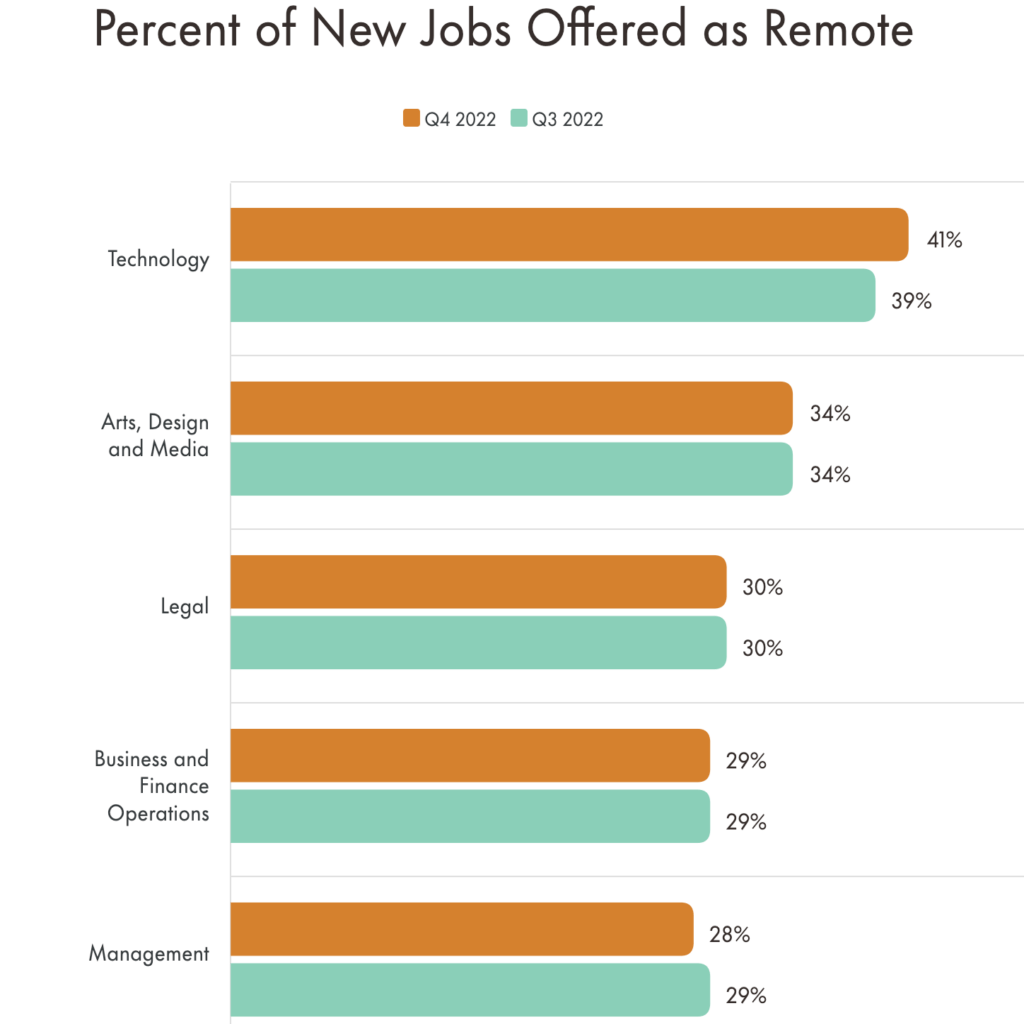

The 2023 RobertHalf Report revealed that in February, 27% of all job postings were for remote work, a decrease from 28% in January 2022. This includes postings from the financial sector, where 29% of the jobs are allowing work-from-home opportunities for several job roles.

Is Finance Consumer Services A Good Career Path?

If you’re looking for a career that is consistently in demand and involves working with people, you may want to consider finance consumer services. This field deals with small businesses and consumers, as opposed to banking services for large businesses. It’s an exciting and engaging field, so if you’re the type of person who enjoys working with individuals, this could be the perfect job for you.

Not only that but combining consumer services with finance is definitely a winning combination in terms of gaining transferable skills. Even if you find that finance isn’t for you, the communication skills you pick up working with customers will stand you in good stead for working elsewhere, allowing you more opportunities to climb the ladder.

If you’re asking yourself the question, ‘What are at least three jobs that are in the consumer services pathway? Then you’ll appreciate our list of remote finance consumer services jobs below.

Remote Finance Consumer Services Jobs

1. Customer Service

Average Salary in the US: 57, 414

Rather than outsourcing, more 100% remote companies are now moving towards having remote customer service teams. As more inquiries come via email, live chat, or ticketing systems on a website, there is less reason for customer service staff to be sat in a cubicle tied to a phone.

According to Indeed, you can earn around $15 per hour when you start in customer service, but this will increase with skill and experience. It will also very much depend on the company you work for and the service standards they expect from their clients. High-end finance has a very different customer profile from local banks.

2. Credit Controller

Average Salary in the US: 60, 757

With a wage of around $80 an hour, there is considerably more responsibility involved in the role of a credit controller. As the name implies, this job consists in managing the credit that a company extends to its customers, which can involve giving them a call to see when you can expect a bill to be paid.

You’ll need good interpersonal skills for this role and a keen eye for detail. You’ll also likely be responsible for compiling monthly reports and presenting these to management.

3. Financial Advisor

Average Salary in the US: 77, 772

Financial advisor roles offer good compensation with a median salary of around $90,000 per year. There are two major routes to go in this career path, either you work for a company and can give advice on the products they sell, or you can be independent and guide your clients to the best fit for them from a variety of different companies.

You’ll need good account knowledge and the willingness to stay up to date with local legislation on tax, investments, and more to do well in this role. A head for numbers also helps, of course!

4. Financial Software Developer

Average Salary in the US: 77, 772

As a remote financial software developer, you will be responsible for developing and maintaining software applications related to financial services. This may include creating web, desktop, or mobile applications, designing databases and software architectures, coding, debugging, and testing applications, and integrating financial data into software systems for banks, financial service companies, or accounting firms.

5. Information Technology Auditor

Average Salary in the US: 93, 446

Information Technology (IT) auditors are responsible for assessing the security and effectiveness of an organization’s IT systems and procedures. You’ll require strong analytical skills to be able to analyze data quickly and identify discrepancies, errors, or potential risks.

Communication skills will be required of course to be able to effectively communicate your findings and recommendations to stakeholders.

10 Best Paying Jobs in Finance Consumer Services

- Financial Analyst

- Investment Banker

- Financial Consultant

- Financial Planner

- Tax Accountant

- Risk Manager

- Credit Analyst

- Commodities Trader

- Actuary

- Securities Analyst

How Many Jobs Are Available In Other Consumer Services?

According to the U.S. Bureau of Labor Statistics, employment of customer service representatives is projected to decline by 4% from 2021 to 2031. Nevertheless, an average of 389,400 openings for customer service representatives are expected each year over the course of the decade. How many of those are remote?

Since consumer service is constantly expanding and these numbers change all the time it’s really hard to put a number on how many jobs are available, so we might just have to confine ourselves to the answer, ‘A lot.’ Listed above are popular ones and the ones that are still available.

What Is The Job Outlook For Careers Within This Pathway Consumer Services?

While you might think that the rise of the chatbot is going to have a negative impact on the outlook for consumer services roles, we don’t think it’s going to be as simple as that. After all, the whole point of consumer services is to establish a human connection, and even the best chatbot can’t manage that. While simple-to-answer queries may fall to the robots, human beings are complicated and will always prefer to have their questions and problems dealt with by other humans.

What Benefits Are Common For Careers In Consumer Services?

There aren’t any unusual benefits for consumer services roles; they tend to be the ones you would expect, including:

- Remote working

- Medical

- Dental

- Flexible working

- Paid holiday

- Paid sick leave

Is Finance Customer Services for You?

As we’ve shown, there is a wide range of different roles in the finance customer services space, so as long as you have a good grasp of numbers, then you should be able to find a role that suits you well. Take inspiration from the roles we’ve suggested above and start looking for your dream job working from home today.