The digital nomad lifestyle looks amazing. Working from a beach, never tied to specific locations. Yet, among benefits, working while traveling has its challenges. And there is one specific challenge we can all relate to: banking.

That’s right. When you plan to work and travel, finding a suitable bank for your digital nomad experience is challenging. From currency exchange fees to expensive ATMs, banking for a digital nomad can be a true nightmare.

So, before packing, make sure you do enough research to find the best digital nomad banks and have the best experience working across the world – after all, it’s the first step to save money and travel the world!

8 Top Digital Nomads Banks

For travelers and digital nomads, these are the best online bank option to keep into account:

- N26

- Revolut

- Stack

- Payoneer

- Starling

- Monzo

- Monese

- Citibank

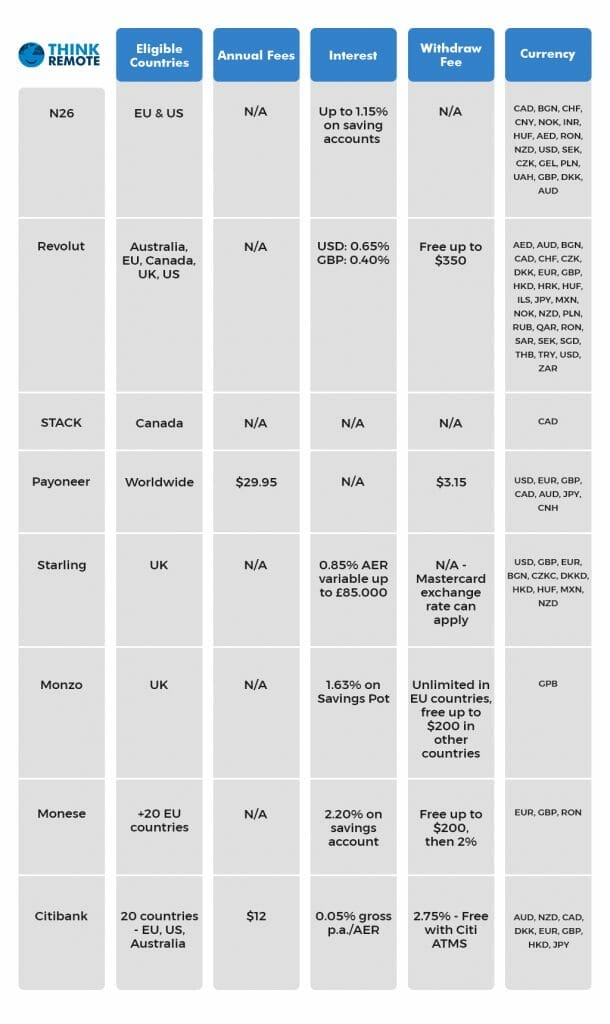

Digital Nomads Banks: A Comparison

Of course, for money transfers and online payments, you can always rely on PayPal or TransferWise. However, a digital wallet or bank account allows you more flexibility and security.

Based on where you live, we have listed the best options you can find in the digital nomad bank market – so to speak. For example, for North American citizens, Citibank, Revolut, and Payoneer are the best options considering currency exchanges and bank branches’ availability. For the U.K. travelers, especially after Brexit, it’s better to stick with UK-based services like Monzo – Most people had to close their N26 account after Brexit was official!

Finally, for Europeans, N26 and Revolut are the most accessible options, but just make sure to check currency exchanges and ATMs’ charges and any potential high bank fees.

Depending on where you are and the scale of your company, here is a general overview of the core features of each digital nomad bank:

1. N26

Germany

N26 is a fully licensed German bank available to US and EU citizens. Since its launch 5 years ago, N26 has reached over three and a half million customers across 27 countries. As a low costs digital bank, N26 works on smartphones with a flexible app that allows instant transactions, online trading and investments.

In addition, members don’t need a physical location to subscribe and access N26’s digital services. For international payments, it works with TransferWise, supporting transfers with 19 foreign currencies from the app.

Type of card: Mastercard

Currencies: CAD, BGN, CHF, CNY, NOK, INR, HUF, AED, RON, NZD, USD, SEK, CZK, GEL, PLN, UAH, GBP, DKK, AUD

Fees:

- Regular: €0/month

- N26 You: €9.90/month

- N26 Metal: €16.90/month |

- ATM: 1.7% ATM (0% for GBP and Metal members)

Payment limit:

- Online: €5,000

- Day card payments: €20,000 / month

N26 Features:

- Spending categorization.

- Free and immediate transfer and money request to other N26 users.

- Separated account for saving, with option to earn interest in some countries.

- Setting up or canceling direct debits is quick and easy with N26.

- Overdrafts (AT and DE).

- Apple Pay and Google Pay.

- 3D Secure online payments.

- Personal loans in some countries.

- Phone insurance with Metal Plan (€16.90 per month).

- Travel insurance (Premium Plans).

| Pros | Cons |

| 24/7 customer support No foreign transaction fees No foreign charge on card purchases Affordable international transfer Deposits and withdrawals with Cash26 Block/unblock cards Set payment limits Change PINs Real-time service Allianz insurance package | No real credit card Withdrawals fees in foreign currency Joint accounts not available Reports of phishing frauds |

2. Revolut

Lithuania

Revolut is a digital bank. Originally based in London, the headquarters is now in Lithuania. It is the most popular digital bank for travelers and digital nomads. Available for androids and iPhones, Revolut allows storing five different currencies in one account and provides convenient plans for crypto trading.

You can open an account from the European Economic Area, Australia, Canada, Singapore, Switzerland, Japan and the US.

Type of card: Mastercard and Visa

Currencies: AED, AUD, BGN, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HRK, HUF, ILS, JPY, MXN, NOK, NZD, PLN, RUB, QAR, RON, SAR, SEK, SGD, THB, TRY, USD, ZAR.

Fees:

- Standard: €0/month

- Plus: €2,99/month

- Premium: €7,99/month

- Metal: €13,99/month

- ATM: 2% fee

Payment limit:

- Online: €250k per transaction, €500k per day, and €1m per week (Uk and EU)

- Day card payments: €3,000 / day

Revolut Features:

- UK and EU current account

- Spending categorization.

- Free account access and use abroad

- International payments

- Different currencies available simultaneously

- Virtual Disposable Cards (premium plans)

- Split bill and pay friends

- Real-time Notifications

- Freeze card

- Set spending limits

- Vault saving account

- Insurance packages

- Cryptocurrency trading

- Trade Stocks

- Apple and Google Pay

| Pros | Cons |

| Free to open and maintain Ever-growing features’ list from virtual cards to crypto trading Travel and medical insurance (premium subscribers) Single virtual account for 29 international currencies Free ATM withdrawals up to €200Affordable international transfers Transparent exchange rates | Customer accounts can be frozen temporarily due to security reasons Poor customer service Possible charge on exchange rates (0.5-1.5%) during the weekends Standard accounts can’t access multiple services Some transfers attract fees |

3. STACK

Toronto

Fintech Canadian company Stack provides a prepaid Mastercard for digital nomads and travelers. In addition to free foreign exchange and ATM withdrawals, the card offers cashback rewards with over 140 partners. As a prepaid card, it’s possible to load money via an Interac e-Transfer, direct deposit, or at any Canada Post location.

In Canada, you can find a network of 10,000 select locations, such as Hasty Market and Mobil. Finally, you can do physical cash at Canada Post with the Stack app and a Stack QR code – minimum $200 and maximum $3,000.

STACK doesn’t charge foreign currency conversion fees. However, any transaction on the prepaid card will be in Canadian currency.

Type of card: Prepaid Mastercard

Fees:

- Annual Fee: $0

- Extra Card Fee: $0

Interest rates

- Purchase: N/A

- Cash Advance: N/A

- Balance Transfer: N/A

STACK Mastercard Features:

- Add money with e-Transfer and Direct Deposit

- No annual, ATM, foreign fees

- Free card replacement

- Digital wallet capability (Apple Pay/Samsung Pay)

- Budgeting tool and automated savings plan

- Worldwide Mastercard network bonus

- $5 Sign-up bonus

- $15 refer-a-friend bonus

| Pros | Cons |

| No annual fee No ATM withdrawal and foreign exchange feesDigital wallet capability Built-in savings tools Worldwide Mastercard network access Convenient referral bonus CDIC coverage Hotel discounts and no travel fee | No rewards points accumulation It isn’t a credit card and cannot help you build your credit score No insurance benefits |

4. Payoneer

United States

Founded in 2005, Payoneer is an online financial service for international money transfers and digital payments. The platform allows corporations to pay partners or employees everywhere in the world. As a result of this payment system, remote workers and freelancers can get paid without additional fees.

Payoneer offers support in 35 languages, connecting to the Mastercard network. Companies like Airbnb, Google, Amazon, eBay, Rakuten, Adobe, Upwork, and Fiverr use the platform for their money transfer.

Type of card: Prepaid Mastercard

Currencies: USD, EUR, GBP, CAD, AUD, JPY, CNH

Fees:

- Set up: Free

- Annual plan: $29.95 (12 months)

Payoneer Features:

- Single Payout

- Receive Payments

- Mass Payouts

- Funds Withdrawal

- Partner Network

- Integrated Payments

- Multi-Currency Support

- Escrow Payments

| Pros | Cons |

| Easy and Intuitive interface Cross-Border Payment Service Fast Billing Fully Integrated Solution Connected Platforms Multilingual 24/7 Support Mastercard network access | Expensive pricing plan Poor customer service High rate for big transactions |

5. Starling

United Kingdom

Founded in 2014, Starling is a digital bank based in the U.K. with a full banking license. For those who are living in the U.K., this card has numerous options. However, it is available only for U.K. citizens and UK-based travelers.

Type of card: Mastercard

Currencies: USD, GBP, EUR, BGN, CZKC, DKKD, HKD, HUF, MXN, NZD

Fees:

- Account Opening: Free

- Account Maintenance: Free

- Monthly Cost: N/A

- ATM: N/A (only in some countries outside the UK)

- Transfer Fee: None with the same currency

- International Transfer Fee: £0.3-5.5

- Currency Exchange Fee: 0.4% for international transfers

- Top-up Fee: N/A

- Overdraft Fee: Equivalent Annual Rate (15%, 25%, 35% based on your credit score)

Starling Features:

- Free Payments with Starling Users

- Smart Saving Features

- 0.5% Interest on Saving Accounts (up to £2,000) and 0.25% on Savings Accounts (between £2,000 and £85,000)

- Personal and Third-Party Loans

- Flexible Overdraft Fees

- Joint Accounts

- Apple Pay, Google Pay, Fitbit, Garmin, Samsung Pay, etc.

- 24/7 Customer Service (Phone or Live Chat)

- Easy Cancellation

| Pros | Cons |

| Banking license: deposit guarantee, direct debits and standing orders Fast account opening 24/7 customer support Personal and Joint account Euro and Teen accounts available Interests of up to 0.5% from your balance Overdraft facilities Personal loans Google Pay and Apple Pay | Must be a UK resident Overdrafts have 15% equivalent annual rate 0.4% fee on international payments £60 charge for lost card £20 charge if you certify documents |

6. Monzo

United Kingdom

Regulated by the Financial Conduct Authority, Monzo has been a fully licensed digital bank since 2015. Created for UK users, it’s a reliable and transparent service replacing traditional banking.

Type of card: Mastercard

Currencies: GBP

Fees:

- Monzo Plus: £5/month ($6.41)

- Monzo Premium: £15/month ($19.24)

- Business Lite: Free

- Business Pro: £5/month ($6.41)

- ATM: Unlimited in EU countries, free up to $200 in other countries

Monzo Features:

- Savings Pot to earn interests on your savings

- Pay friends and split bills

- Shared Tabs to track payments

- Save spare change tools

- Customizable

- Salary sorter

- Energy switching

- Joint accounts

- Apple/Google Pay

- Monzo Flex

| Pros | Cons |

| Easy to set up Free cash withdrawals abroad No transaction fee Overdraft and loans Competitive savings rates Automatic savings | Exclusively for UK residents Daily withdrawal and spending limits App-only: no bank branches Max deposit: £1.000 every 6 months ($500 if you are 16/17) |

7. Monese

Monese is also a UK digital bank founded in 2015. Unlike Monzo, it is possible to open an account as an EU resident. The service provides a 100% mobile current account supporting different currencies.

Type of card: Mastercard

Currencies: EUR, GBP, RON

Fees:

- Classic: €/£5.95/month – Since August 2020, this option isn’t available in some countries

- Premium: €/£14.95/month

- ATM: Unlimited in EU countries, free up to $200 in other countries

- Foreign currency card spending: 2% (Free under certain limits)

Exchange rates:

- Classic: 0.5% (£2 minimum)

- Simple: 2.0% (£2 minimum)

- Premium: FREE

Monese Features:

- Automatic Bills Protection and Purchase Protection

- Easy account opening

- Contactless Mastercard

- Immediate transfers

- International payments

- Saving Pot

- State-of-the-art protection

| Pros | Cons |

| 100% customer funds protection IBAN accounts + bank card No proof of residency required Fast bank transfers Affordable international bank transfers Direct debits Unlimited transactions Multi-currencies support Low currency exchange fee | It is not a real credit card, so you can’t buy and pay the next month. You can spend what you have on the card. Exclusively for EEA residents |

8. Citibank

Australia

Citibank is based in Australia and it covers 20 countries worldwide. As a large bank, it provides over 2,300 branches and 60,000 ATMs in the U.S. However, it requires minimum balance requirements to waive fees. This option best suits those who prefer access to bank branches and ATMs and have a solid financial background.

Currency: AUD, NZD, CAD, DKK, EUR, GBP, HKD, JPY

Fees:

- Opening account: Free

- Interest earnings: 0.05% gross p.a./AER

- Annual fees: $12

- Withdrawal fees: 2.75% fee on non-Citibank ATM

Citibank Features:

- Personal Loans and Lines of Credit

- Purchase and refinance mortgages

- Home Equity Loans and Lines of Credit

- Individual Retirement Accounts (IRAs)

- Self-Directed Trading

- Managed Investment Portfolios

- Private Banking

- Financial Advisors

- Business Loans

| Pros | Cons |

| No minimum deposit to open checking and savings accounts Credit card issuer Over 60,000 fee-free ATMs throughout the U.S. | Requirements for monthly fees on checking accounts Account check required to open savings accounts Up to $2.50 charge for another bank’s ATM |

Final Thoughts

Subscribing to the right digital nomad bank is like finding your soulmate. Once you get the one that suits you, you know, never change a winning team. When choosing the best bank for your digital nomad lifestyle consider if you prefer virtual service or prefer bank branches. Estimate how much is a priority for you for multi-currency support and international payments.

After that, it is time to open an account, close up your backpack, and travel the world!