Remote entrepreneurship gives you an opportunity to build more wealth. While you work from anywhere in the world, you can cut down many expenses that come with a brick-and-mortar office setting. Moreover, you have more time and money to invest. You can create multiple streams of passive income by using your spare time to learn about your financial health. Some saving and investing methods can help you secure your future. Let’s figure out how to make your money work for you.

Putting it in Warren Buffet’s words,

“If you don’t find a way to make money while you sleep, you will work until you die.”

As a remote business owner, you have an advantage. More time to research and learn about all things finance and more money to invest and multiply.

It’s time for you to wear your investment hat. Let’s get you started with some money-saving and growing tips right here.

The Best Remote Ways To Make Your Money Work For You

I wasn’t the “saving” kind of person when growing up. I had started two ventures before, and they failed before I could see a buck bigger than my previous income as a white-collar employee of a well-known media company.

I had the perfect plan, a great team, and a foolproof plan for success. What went wrong?

I wasn’t remote, and I had no idea about savings and investments. I spent on office rent and other expenses that came with it before getting my first client. Moreover, I spent more than I made every month. Before I realised, I wasn’t only nil but in the negative with debt riding my back. I had no option but to shut shop and start my life over.

But this time, I wanted to let go of my old school thought that finance management is only dependent on temperament. Either you’re good at it or bad at it. That’s not true. Like many other things in life, you can unlearn, learn and relearn a lot about finances. Educating yourself on the subject is the key.

I didn’t even think of going remote at that time, and that was the first mistake I made as a first-time entrepreneur who started with zero income. I started with expenditure instead. How could I make my money work for me when I had none? As a remote entrepreneur you’re starting without extra expenses.

Here are some things I educated myself on right after my doomed entrepreneurship ship sank. These tips can help you avoid the mistakes I made and can make your money work for you.

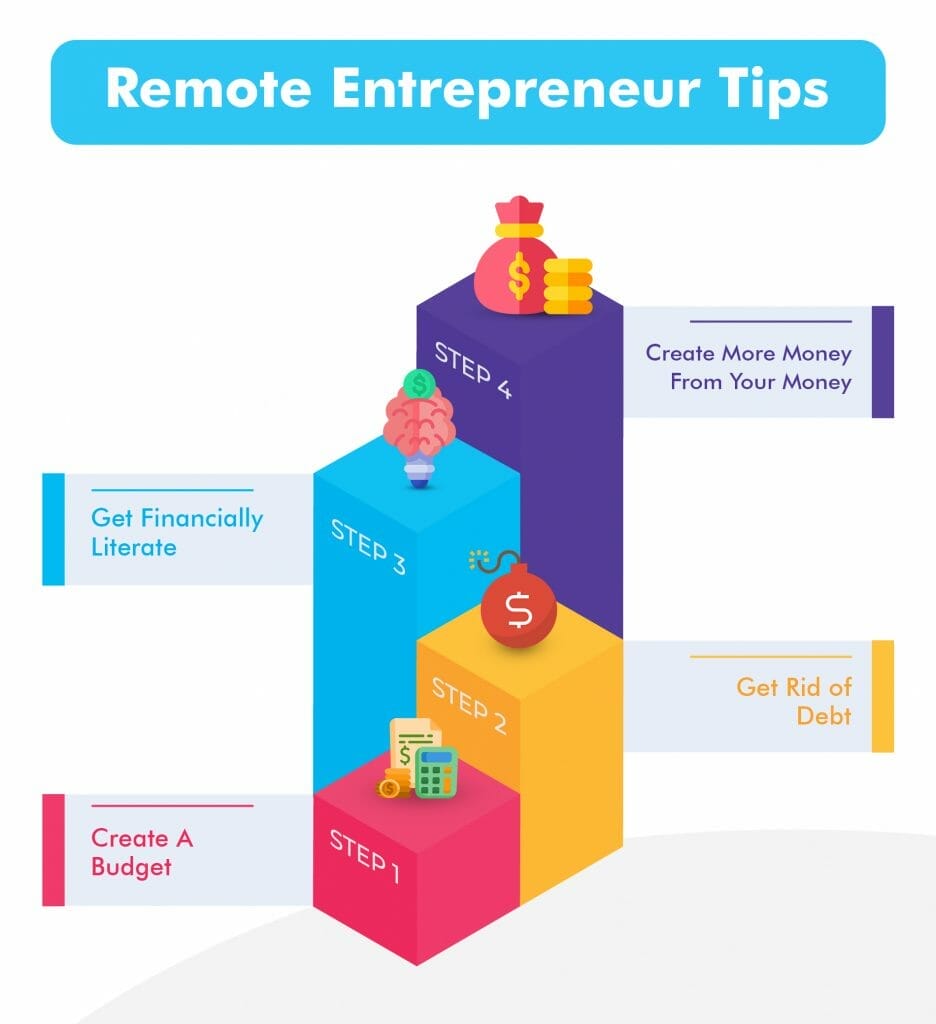

1. Create A Budget

This isn’t the budget aimed at spending more but saving more instead. Budgets and finances can be a boring topic for some. If that’s the case with you, know that it is much easier to create a budget and stick to it than having no plan and failing.

Also, creating a budget structures your income and expenses. This will help you understand the daily and monthly flow of money. You’ll be able to see unnecessary expenses and minimize them.

Here’s a list of things you can include in your budget plan:

Fixed Expenses

As the name suggests, fixed expenses are fixed. They can’t be skipped because they’re essential for your everyday life. The amount of money to be paid for these necessities remains the same.

- Rent or mortgage repayments

- Childcare costs

- Phone and internet bills

- Househelp costs

- Insurance

- Debt repayments

Variable Expenses

Some of the regular expenses that we bear are necessary but the amount on the bill might vary every time. Such bills or items can be tagged as “variable expenses”.

- Utilities such as electricity and gas

- Food and grocery costs

- Medical expenses

- Vehicle and transport

- Education related expenses

Discretionary Expenses

Discretionary expenses are those which aren’t for necessary items or services. Instead, they’re related to our interests and leisure. It’s important to take breaks and take care of oneself so these aren’t unnecessary expenses. However, overindulgence can hurt your financial health.

- Eating out

- Sports and other activities

- Shopping

- Personal care items

- Hobby classes

- Sports, Travelling, and other activities

Learn more about how to save money while travelling, Click Here.

You can include whatever you think fits in these categories. Since you’re a remote entrepreneur, you might see higher expenses being added to the travelling and eating out categories. It’s best to not exclude anything in order to get a clear picture of your finances on a daily and monthly basis.

2. Get Rid of Debt

There’s nothing more crippling than debt. It cripples not only your finances but also your mental health. You can’t focus and work properly if repayments are always on your mind. If the debt is big, you might also have sleepless nights that will affect your work and personal life too.

It’s ideal to not get into debt in the first place, but for any reason, if you did need to borrow money at some point in your business, you need to create a clear repayment plan and stick to it.

Here are some steps that you can take:

Start With The Biggest Number

Putting the scariest and the biggest debt aside for later can cause you prolonged stress. That’s why clearing the biggest debt first can get you faster relief. Start with repaying the mammoth loan first. Come down to the smallest one last.

It’s just like our tasks at work. Some people tend to do the smaller tasks first. If you’ve done something like this before, you’ll know that as the day progresses, you lose energy and focus. If you leave the biggest task for the last, you might end up doing a sloppy job or skipping the task altogether. Whether tasks or debt, don’t leave the biggest for the last.

Create A Step By Step Plan

You had a plan when you started your remote entrepreneurship journey. Everything is more structured and easier when there’s a roadmap. Debt repayment is no different. Creating a step-by-step plan will help you with an estimated timeline of fully repaying all loans. You’ll be able to plan other things better and focus on your business rather than worrying about “how” you’ll repay your cards and loans.

Here’s how you can create a repayment plan for yourself:

- Create categories such as cards, bank, personal, etc to segregate your loans. This will help you track how much you owe to each category.

- Pick out the biggest loan and eliminate that first. Biggest doesn’t necessarily have to be the biggest number. It can also be a loan with the highest interest. Usually, credit cards have a very high interest rate and eliminating that debt will be the best to start with.

- Every month, you’ll continue to repay a minimum amount in each one but the cash you save from your earnings should be dedicated to the loan you want to finish first. Eliminate that one and move to the next. Repeat the same process till you repay all your loans and get out of debt.

It sounds cumbersome but it is a big relief after you’re done repaying your debt. Think where you can save more by cutting out extra expenses. You’ll be able to see those in your budget plan.

After you’re done with your debt, there’s just one more step you need to take, never get into debt ever again.

3. Get Financially Literate

There’s no shame in not knowing even the basic stuff when it comes to money. It’s natural for us to not explore the topic in-depth because they didn’t teach us about financial challenges and building wealth in schools, did they?

You don’t need to have an academic background in finance to be a pro investor. You need some knowledge and some basic understanding of how finances flow and work. By simply tracking when your money comes and where it goes, you can go a long way with savings and investments.

Fret not, you don’t need to go all over the internet looking for what to do because here’s a list of simple courses on finance. They’re not academic courses for you to find a job as an accountant but the ones that can help you build a financially secure future for yourself.

- Budgeting: How to Save Money by Eliminating Spending Leaks – Udemy

- Managing Debt – Coursera

- Investing for Beginners – Coursera

- The Beginner’s Guide to Stock Market Dividend Investing – Udemy

These can get you started on your journey to more financial freedom. If you’re interested in reading books on investments and finances, there are some amazing books about investing for beginners.

Once you’re better acquainted and confident with some knowledge, you’ll be able to grasp investment methods faster.

4. Create More Money From Your Money

Your business does that for you but there are more ways to multiply the money your business makes? Making your money work for you isn’t just about saving and getting out of debt. What next? The next step is to save up and invest and let that money grow. Invest where and how? Before we get to that, let’s understand some things that can help your mindset.

- Be patient. Most investments are for the long term so don’t expect becoming a millionaire overnight. That happened neither for Warren Buffet nor Will Smith. Every craft takes practice and years of hard work before you see success.

- Calculating risks is important. Some types of investments might look like they’re going to help you hit the jackpot but if they’re high risk investments, you could end up being a pauper too. Be smart instead and avoid acting impulsively.

- Don’t put all your eggs in one basket. A little here and a little there can help you assess what’s working better for you. Don’t invest all your money in one type.

Here are some good options to explore as a remote entrepreneur:

Stocks

As a remote entrepreneur, you can buy stocks in a company. Shares is another word for stocks. Investing in single stocks is risky. If you’re unsure about a company and have your doubts then you can go for index funds or ETFs. These hold multiple shares or stocks of various companies.

If you’re thinking that a huge capital is needed to start investing in stocks, you’re wrong, Entrepreneur and stockbroker William O’Neil dismissed the myth in his book How to Make Money in Stocks:

“If you’re a typical working person or a beginning investor, you should know that it doesn’t take a lot of money to start. You can begin with as little as $500 to $1,000 and add to it as you earn and save more money.”

ETFs

Exchange Traded Fund or ETFs offer you a combination of different types of investments. This is a fund that can be traded on an exchange like a stock. You can buy and sell it throughout the day.

ETFs usually have a lower fee than other types of funds. The level of risk depends on the type you choose. These can be stocks, bonds, and other securities. ETFs are traded multiple times a day and are tax-efficient too.

How does ETF work? An ETF’s value moves in sync with the index it tracks. For example, a 1% rise in the index would result in approximately a1% rise for an ETF that tracks that index. You’ll be able to see this rise or fall in the gains or losses to your returns.

These types of funds are a good option to go for as a remote entrepreneur, especially if you’re investing for the first time.

- They’re a good option for low-key investors.

- They contain multiple assets and you’ll have a less risky, diversified portfolio.

- They have a lower fee as compared to other funds.

With ETF fund providers like Vanguard, iShares and SPDR you’ll be able to sign up online in just a few minutes. Do your research and compare the funds. If you’re confused, it is best to talk to a financial advisor about which one is the most appropriate for you.

Real estate

This might seem to be an old fashioned way of investing but that isn’t the case. Even today, it is a preferred choice of investment for a lot of people for its ability to generate long term returns. This is for those who have the capacity to invest significant capital upfront as you’ll need to make a down payment.

Since there are many tax deductions for expenses connected with rental property, it is also a tax-effective way to invest. If you have the capital, then it is a good option to go for.

Before you purchase a property,

- Research the property, it’s location and nearby developments to understand the long term benefits.

- If you’re unsure and have never invested in real estate before, it is best to take the help of a property consultant to get a better understanding.

Real estate investment trusts (REITs)

REITs are a good investment option for those who can’t afford to buy property or don’t want to take the risk. An REIT is a company that owns real estate.

If you invest in REIT, you’ll benefit from the sale, income (or loss), and refinance on the property. This will be paid to you in the form of dividends by the company. However, it is important to note that these dividends are taxed as ordinary income and are taxable so you might end up in a higher tax bracket.

To invest in REIT you can purchase shares through a broker like eTrade. If you’re a first timer, it is advisable to seek the help of a professional REIT investment agent or someone who has experience in REIT investments.

Cryptocurrency

For the uninitiated, cryptocurrency is a digital asset. The name lives up to the fact that transactions with cryptocurrency are highly encrypted. You can be sure that you’re dealing with a highly secure asset. Also, investments with cryptocurrency come with an advantage – it is decentralized. Other traditional investments are controlled and monitored by a central authority.

Most cryptocurrencies use blockchain that records and manages all transactions. There are multiple identical transaction records because of the encryption which keeps all transactions highly secure.

There are over 10,000 listed cryptocurrencies that you can invest in. Bitcoin has the largest market share (about $650 billion) preceding Ethereum and Tether.

If you’re still confused and unsure where and how to start with cryptocurrency, you’ll find multiple online courses that can help. Udemy and coursera can help you understand the subject deeper before you decide to invest.

Lead a Financially Secure Life

Being a remote entrepreneur doesn’t have to be without stability and security. When it comes to finances, the road of remote entrepreneurship will open up multiple investment doors for you. No matter where you work from, you’ll have secure investments that, just like you, will grow with time. Making your money work for you comes with some patience, dedication, and some simple steps as mentioned above.

If you lose your way and get confused, you can always come back to this guide. Bookmark this page and start your journey to financial freedom.

Save, invest, grow.