You’ve decided to embrace the nomadic life. It has been your dream since forever, and now it is coming true, but you’re kind of jittery. Ironically, with all that freedom comes a little bit of fear too, and the biggest of all fears is financial planning. It seems like you won’t really be able to save any money. You plan to move places from time to time, eat in different cities or even countries, pay various weekly or monthly bills, travel a lot, etc. and after all of this expenditure are digital nomad budget savings really a possibility?

Your main concerns are sustaining in a different country and whether or not you’ll have any savings for emergencies and your future. Fret not. There’s nothing that planning and hacks can’t solve!

This guide will help you improve your financial planning before, during, and after your nomadic journey!

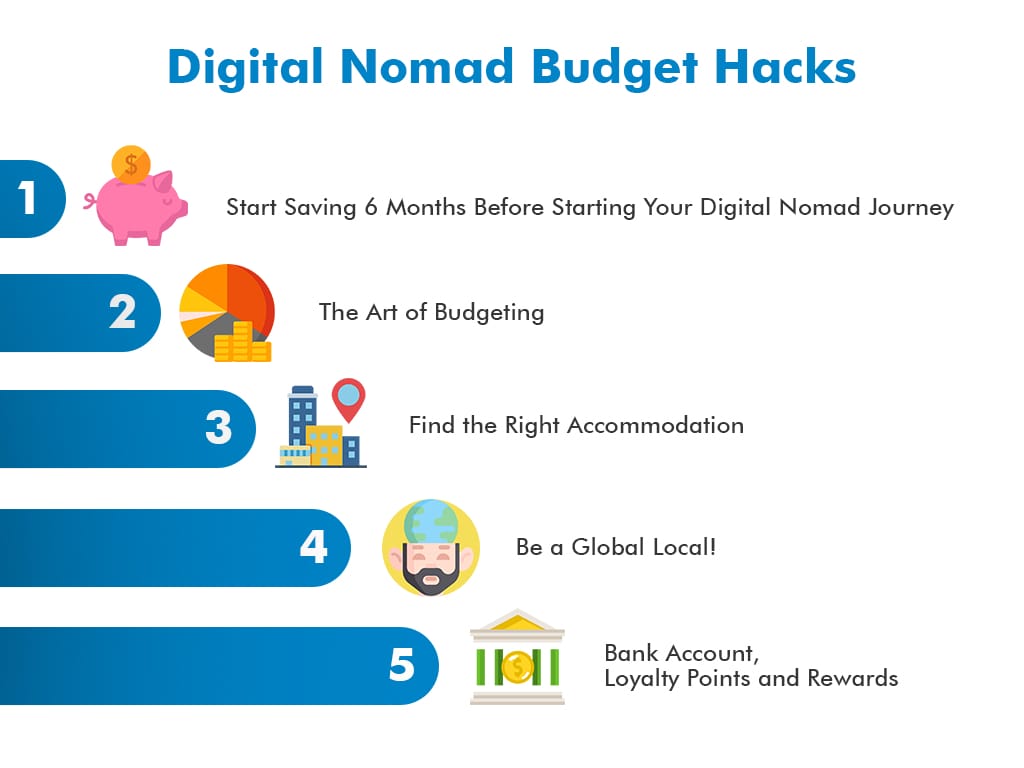

Hacks for Digital Nomad Budget Savings

1. Start Saving 6 Months Before Starting Your Digital Nomad Journey

Dreaming is great! Without having a dream, what do you work towards and what do you live for? Having said that, to really make it come true, you need to plan well. When it comes to financial planning, it is advisable to start saving at least 6 months before you begin your digital nomadic lifestyle.

You probably have multiple recurring debits like grocery or gym memberships and other subscriptions that you won’t need once you move out of your current permanent residence. It is best to start cutting these off from your expenditure. You’ll see a notable change in how much you end up saving.

If you plan to move to a country that could be expensive for your day-to-day living, it is best to cut down on additional and unnecessary expenditure. For instance, if you’re used to having coffee at a cafe every day, you can start making coffee at home instead. You’ll be surprised at how much you will save every month just by cutting off your unnecessary daily spending.

As you get closer to moving out, you can start selling the belongings that you will no longer need. Furniture and appliances can fetch you good money. Sell off everything that you won’t be taking with you.

If you own your current home, you can rent it out in order to generate a fixed regular income for yourself! You can do the same with your car, if you don’t plan to have road trips.

2. The Art of Budgeting

Budgeting is an art. It requires you to differentiate between needs and wants. You need to be very practical with budgeting and depending on your next destination, you need to do your research first.

How much will accommodation cost you? What will your daily expenses look like? Calculate all the major fixed and recurring expenses till you come to a rough figure of the impending monthly expenditure and create a budget plan.

The first month will be crucial. Keep a tab on all your expenses and at the end of the month, match it with the rough budget you created before. Make the necessary changes. If this figure is exceeding your monthly income, you’re in the negative. You will need to figure out where the extra spendings are happening and then chop them off.

Consider the amount that you have left at the end of the month as your savings. Make sure it isn’t too low and is a comfortable enough amount because every month will not be the same, and this amount may vary. It’s good to be prepared for rainy days!

Ensure that there are not many variations to your overall regular expenditure after two or three months unless you’re moving again. Once you get used to being a digital nomad, budget savings will become easier and you’ll be able to stick to your budget without many ups and downs in the numbers.

The important thing is to stick to the budget you’ve created! To help you with this, there are multiple ways in which you can track your daily expenses. Google spreadsheets or Microsoft Excel are used but some people might find them boring. If that’s you, then check out apps like NomadWallet or Mint which are widely used by digital nomads across the globe.

3. Find the Right Accommodation

Accommodation will eat up most of your income. As a digital nomad, you will most likely not have a permanent residence. It won’t always be easy to save money while travelling. You will keep moving and exploring new destinations. Some will be cheap while others will be very expensive.

Stay away from renting a house or an apartment all for yourself. Instead, you could go for Airbnbs that are affordable and have a good WiFi connection (trust me, you’ll need this if you don’t want any hindrances to your work). You could also opt for coliving with other digital nomads who have similar interests as you do.

These options will greatly reduce your expenditure. Accommodation spends are best reduced when shared.

Pro Tip: Most places offer great discounts if you book them for a longer period of time. Avoid short stays. Instead, look for the best deals that you can grab with longer stays!

4. Be a Global Local!

The new cuisine is so exciting that you gorge on all that you feast your orbs on. That’s absolutely okay! At least in the first few weeks, after which it is wise to realize that you’re not a tourist in this new destination but a local for as long as you’re going to be there.

Don’t confuse digital nomadism with a vacation. You’re moving to new destinations to explore and experience new things, no doubt. However, you’re choosing this as a regular lifestyle as opposed to choosing it as a fancy vacation.

Don’t be in tourist-mode for a long time unless you want to end up broke! To avoid this, observe the locals. Where do they eat on a regular basis? Which are the cheapest restaurants that serve tasty and hygienic meals?

Forget a fancy ambience or a postcard worthy backdrop. Remember, you’re not a tourist but a local. It will save you a good amount of money to live like a local. Local food and local transport that is cheap and reliable will help you keep your expenditure in check.

If you’re someone who has the time and the facilities for cooking their own meals, there is no better option than this! Be your own chef, and your bank account will thank you. Remember that it is a healthier option too.

The exact same plan applies to transportation as well. Don’t go around renting any expensive modes of transportation. If cabs are very expensive and you’re planning to commute regularly, it is best to opt for local transportation in that particular place.

5. Bank Account, Loyalty Points and Rewards

The two essentials that will become your bag’s best friends are your mobile phone and your credit/debit cards! Choose credit and debit cards that don’t charge international fees on ATM withdrawals since you’ll be traveling so much.

Schwab Bank High Yield Investor Checking Account, TransferWise Borderless, and N26 are popular among digital nomads. These bank accounts are free to open, and everything is online. These banks don’t charge ATM withdrawal fees for most countries! You can manage everything on an app, and their customer support is great too. No need to maintain a high minimum balance in your bank account anymore which also means no unnecessary penalty fees.

The best cards are the ones that can give you a lot of travel rewards. These rewards can help you pay for your flights! Also, the cards that waive off international transaction fees and give cash backs on purchases are the best.

Go On and Live Your Digital Nomad Dream

Don’t let your fears overpower your longing for freedom! If you’ve been thinking of living as a digital nomad for quite some time but have been skeptical about how to manage your budget and savings, you can always refer to this guide that will help you stick to your decisions. Bookmark this page and get back to it whenever you feel like you’re sliding down the “tourist” path again.

Take that first step, plan well and take off!