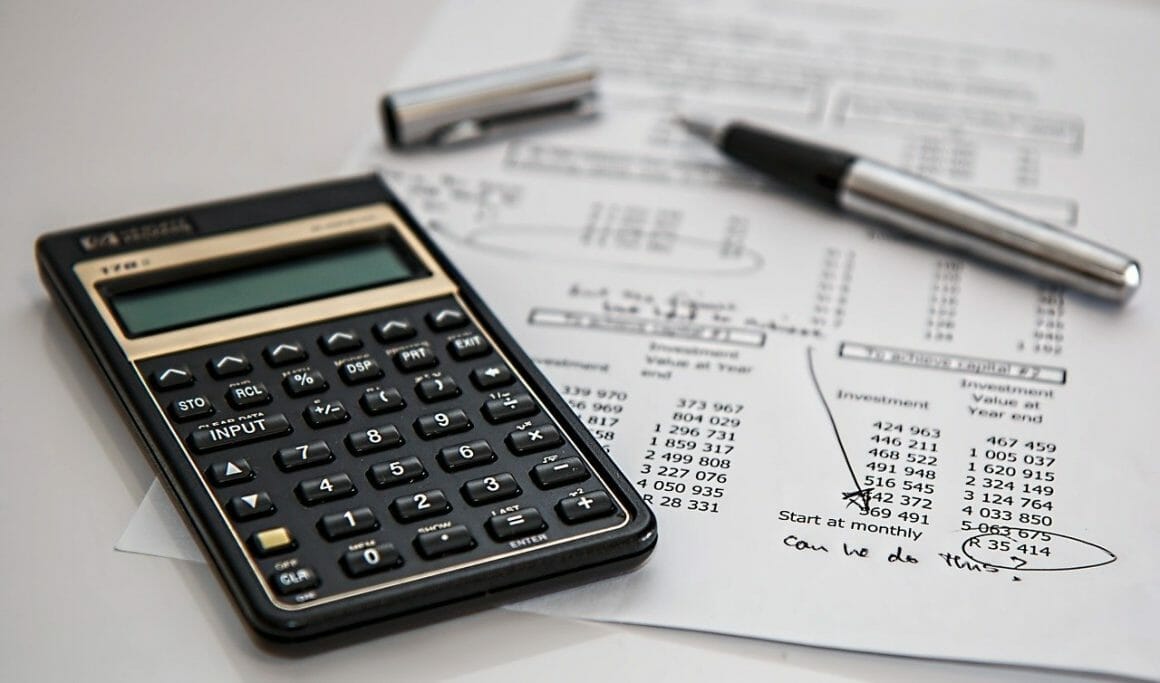

Remote workers will be allowed to claim back 30% of their energy bills against their tax.

Paschal Donohoe, Finance Minister of Ireland, said that the government plans to support remote work and confirmed an income tax deduction of 30% on heat, electricity, and broadband bills.

The currently claimable rate is 10% of the total amount of utility bills against the taxes.

Donohoe said the increased measure will be formalised in the Finance Bill to be passed in the Dáil. Workers can claim the percentage back on their bills for the days they are working at home.

The minister said the the daily working from home allowance that is paid by some employers will remain unchanged but it hasn’t been increased in the Budget. The current rate is €3.20 and is an optional payment made by companies for their remote employees.

Under the current rules, Revenue allows those working remotely to claim either the tax relief on the additional costs of working from home, including electricity and heat or opt for the employer daily payment, if it is available to them.

John Riordan, a director of support at Shopify lauded the move by the government.

“The Government also said that remote work is a cornerstone of continued economic growth which is a strong statement. This is now the time to ensure that service and utility providers to take steps to facilitate this initiative. Thousands of people will start asking for an annual statement to claim tax relief, so let’s work now to enable that to go smoothly so we don’t end up having people scrambling around to try and claim tax relief and then having the benefit spoiled.”

John Riordan, Director of Support, Shopify

Subscribe to Think Remote for the latest news, tips and stories from the remote work world.